|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

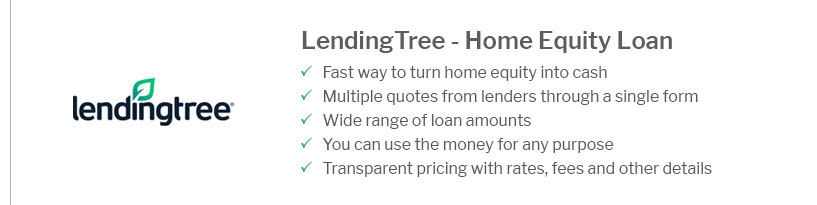

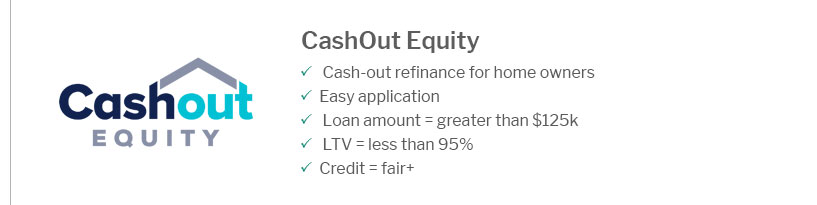

Today's Refinance Mortgage Rates: What You Need to KnowUnderstanding Refinance Mortgage RatesRefinancing your mortgage can be a savvy financial move, especially when today's refinance mortgage rates are favorable. By securing a lower interest rate, homeowners can reduce their monthly payments and save money over the life of the loan. Factors Influencing Refinance RatesSeveral factors can influence the refinance rates you receive. Lenders consider your credit score, loan-to-value ratio, and the amount of equity you have in your home. Current Market TrendsAs of today, refinance rates are influenced by economic indicators such as inflation and Federal Reserve policies. It’s crucial to stay informed about these trends to make the best decision for your financial future. Steps to Refinance Your MortgageRefinancing your mortgage involves several key steps that can lead to significant financial benefits. Evaluate Your Financial Situation

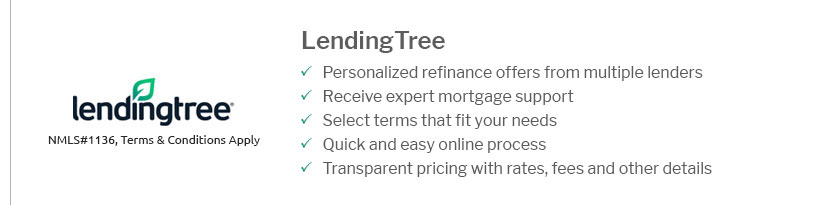

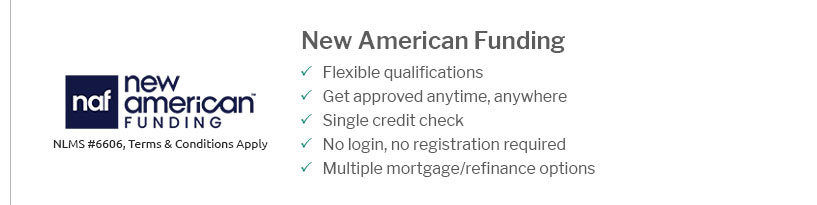

If you are a first-time homebuyer, you might want to apply first time home loan to understand your options better. Shop for the Best RatesContact multiple lenders to compare rates and terms. Consider reaching out to private home loan lenders for more personalized service. Common Mistakes to AvoidAvoiding common pitfalls can help you maximize the benefits of refinancing. Not Locking in Your RateLocking in a favorable rate is crucial. Rates can fluctuate, and failing to lock in a good rate can result in higher costs. Ignoring Loan FeesBe aware of the fees associated with refinancing. These can include application fees, appraisal fees, and closing costs. Make sure you understand these costs before proceeding. FAQ

https://www.cbsnews.com/news/what-are-todays-mortgage-and-mortgage-refinance-interest-rates/

We've compiled a list of today's average mortgage and refinance interest rates below. Start here and compare the best mortgage rates you can qualify for today. https://www.usbank.com/home-loans/refinance/refinance-rates.html

Today's 30-year fixed refinance rates ; Conventional fixed-rate loans - 30-year. 6.625%. 6.799%. $2,971 ; Conforming adjustable-rate mortgage (ARM) loans - 10/6 mo. https://www.lmcu.org/rates/mortgage/

Mortgage Rates ; 7 Year Adjustable Rate - 5.990%, 0.424%, 6.531%. 6.115% ; 5 Year Adjustable Rate - 5.740%, 0.984%, 6.591%. 5.865% ; 7 Year Adjustable Rate Jumbo ...

|

|---|